All Categories

Featured

Table of Contents

You do not need to be certified to attach Fundrise, and you absolutely don't require to invest a minimum of $25,000. Customers can begin investing on Fundrise with as low as $10, though you will certainly require a much higher account balance to access several of the more unique offers.

You're surrendering a little bit of control in terms of selecting and managing genuine estate financial investments, but that could be a good idea for capitalists who don't have the time or expertise to do the due diligence that Fundrise carries out on your behalf. Low/flexible account minimums. Reduced fees, even contrasted to comparable services.

Lets you invest in actual estate funds, not private residential properties No control over how funds are taken care of or how properties are gotten. Investment takes time to pay off.

A great series of deals is readily available with various yields and timetables. Growth and Revenue REIT and Prism Fund are offered to unaccredited capitalists. Must be recognized to buy most possibilities. Deals are well-vetted but still high-risk. High minimal financial investment limits. $10,000 Development and Earnings REIT and YieldStreet Prism Fund; Varies for various other investments0 2.5% annual administration fees; Additional fees vary by investmentREITs, funds, real estate, art, and various other alternate investmentsVaries by investment DiversyFund is among the very best realty financial investment applications as it gives unaccredited investors the chance to obtain as near direct realty financial investments as the legislation enables.

What are the top Accredited Investor Real Estate Investment Groups providers for accredited investors?

The simple app gives investors the chance to get in on the activity. While you do require to be recognized to obtain in on some of their costs possibilities, DiversyFund doesn't require accreditation to get right into their slate of REITs and private actual estate investments.

Their application is constructed from the ground up to make buying property really feel seamless and user-friendly. Every little thing from the spending user interface to the auto-invest feature is made easily of use in mind, and the care they take into creating the application shines through every faucet. By the way, if you're captivated by the idea of living in a component of your financial investment residential or commercial property and leasing out the rest, house hacking is an approach you could wish to discover.

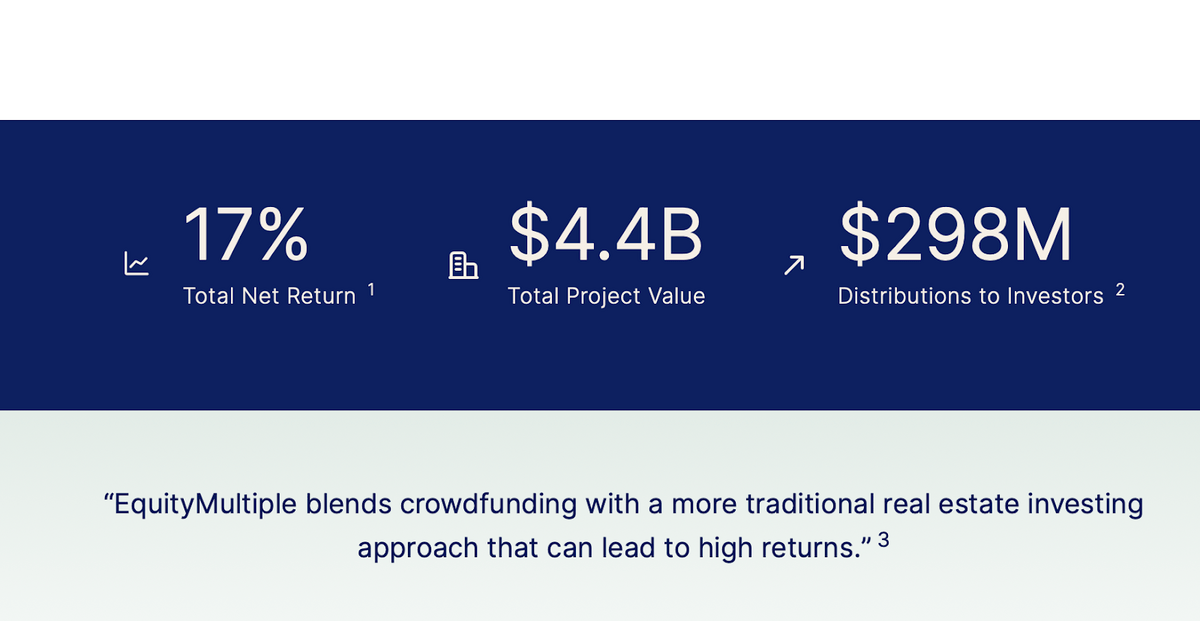

User friendly application makes spending and tracking investments basic. The auto-invest feature allows you routine automatic contributions to your financial investment. Just one sort of underlying asset. The largest offers call for certification. Fairly restricted footprint (only 12 present multifamily assets). $500 Growth REITs; $25,000 Premier Opportunity Fund (accredited); $50,000 Premier Direct SPVs (certified) Differs based on investmentREITs, multifamily homes, personal property 5 7 years EquityMultiple has this very obvious quote on their home page from Nerdwallet: "EquityMultiple mixes crowdfunding with a much more typical property spending approach that can result in high returns." And though we would certainly have quit at "method" for the sake of brevity, the Nerdwallet quote amounts up EquityMultiple's overall values rather perfectly.

What should I look for in a Accredited Investor Property Investment Opportunities opportunity?

Wide variety of investment opportunities offered. Accreditation is needed for all financial investments. Many chances have high minimal financial investments.

The majority of people aren't accredited financiers, so it adheres to that lots of people don't have 5 or 6 numbers worth of unspent resources simply existing around. Again, most of the solutions provided below do call for considerable minimal financial investments, yet not all of them. Investing should not be the sole province of the abundant, so we consciously included services that don't require cars and truck loan-sized minimum investments.

No person likes charges, so it's only all-natural that you would certainly intend to stay clear of paying huge management fees or annual service fees. That claimed, companies require to earn money somehow. If they aren't billing you a minimum of something for their effort and time, then they're likely being paid by the people whose financial investment possibilities they're offering.

What does Accredited Investor Real Estate Deals entail?

We intend to suggest solutions that have your benefits in mind, not the interests of the financial investment producers. This set is additionally easy and was more of a nice-to-have than a need. At the end of the day, the majority of the property spending apps out there are essentially REITs that private investors can acquire right into, so we do not anticipate them to have a massive variety of investments available.

Ultimately, we provided some consideration to the suggested or needed length of time for each and every service's financial investments. Genuine estate returns are gauged in years, not weeks or months, yet we really did not want to recommend anything that would lock your money up for a decade or even more. Was this write-up useful? Thanks for your comments!.

Some consist of choices available for non-accredited capitalists, however examine the checklist to know for certain., adhered to by more detailed summaries of each one: PlatformClass vs.

As an investor, capitalist'll be participating in taking part purchase and acquisition of possession farmland. As it transforms out, farmland has proven to be a fantastic lasting investment.

While it's unfavorable for consumers, farmland financiers stand to obtain. What's even more, farmland stands for ownership in a "difficult asset (Accredited Investor Property Portfolios)." That can be a big advantage in a portfolio consisted of entirely of monetary possessions. Your financial investment will certainly give both dividends paid of the web rental earnings of the farm residential property, along with capital gains upon personality of the farm.

How can Real Estate Crowdfunding For Accredited Investors diversify my portfolio?

You can invest in different genuine estate offers, like single-family residential or commercial properties or multiunit house structures. You can also invest in excellent art, commercial airplane leasing, brand-new industrial ships, industrial financing, and also legal offerings.

There is no management cost, and the typical holding duration is 3 months. Yieldstreet can also fit IRA accounts using a self-directed individual retirement account (SDIRA), and their management fee of 1% to 2% each year is very competitive. As a matter of fact, temporary notes have no management cost whatsoever. Read our our Yieldstreet review for a deeper study the system.

Latest Posts

Tax Forfeited Property

Back Tax Property For Sale Near Me

Government Taxes Foreclosures