All Categories

Featured

Table of Contents

Tax lien certificates, also called tax obligation implementations, certifications of purchase, and tax obligation sale certifications, are tools sold by neighborhood, county and local governments as an approach of recuperating real estate tax bucks deemed overdue because of the homeowner's failing to satisfy the financial obligation. The issuance of tax obligation lien certifications to capitalists is usually done in an auction setup where the effective prospective buyer is determined by the least expensive rates of interest proclaimed or the highest possible bid for cash money.

6321. LIEN FOR TAXES. If any individual liable to pay any kind of tax forgets or rejects to pay the exact same after demand, the amount (including any kind of rate of interest, added quantity, enhancement to tax, or assessable fine, together with any type of costs that may accrue in addition thereto) shall be a lien in support of the United States upon all property and civil liberties to home, whether genuine or personal, belonging to such person.

Department of the Treasury). Generally, the "person reliant pay any kind of tax obligation" defined in section 6321 needs to pay the tax obligation within 10 days of the composed notice and demand. If the taxpayer falls short to pay the tax obligation within the ten-day duration, the tax lien occurs automatically (i.e., by operation of law), and is efficient retroactively to (i.e., develops at) the date of the assessment, also though the ten-day duration necessarily ends after the evaluation day.

Is Tax Liens A Good Investment

A federal tax obligation lien occurring by legislation as defined over stands versus the taxpayer with no additional activity by the government - tax lien investing reddit. The general policy is that where 2 or even more financial institutions have contending liens versus the very same home, the lender whose lien was developed at the earlier time takes concern over the financial institution whose lien was improved at a later time (there are exceptions to this rule)

The form and material of the notification of government tax lien is controlled only by government law, despite any type of needs of state or local legislation. The NFTL is merely a gadget which provides notification to interested events of the existence of the federal tax obligation lien. Therefore, the NFTL's feature is to ideal and get top priority for the federal tax obligation lien.

Some instances include the liens of particular buyers of safety and securities, liens on specific car, and the rate of interest held by a retail purchaser of certain individual building. Federal regulation additionally enables a stateif the state legislature so elects by statuteto take pleasure in a greater concern than the federal tax obligation lien relative to specific state tax liens on residential or commercial property where the related tax obligation is based on the worth of that property.

How To Invest In Tax Liens

In order to have the document of a lien released a taxpayer needs to acquire a Certificate of Release of Federal Tax Lien. Normally, the IRS will certainly not issue a certification of launch of lien up until the tax has actually either been paid completely or the internal revenue service no much longer has a legal interest in accumulating the tax obligation.

In circumstances that receive the removal of a lien, the IRS will usually eliminate the lien within 30 days and the taxpayer might obtain a copy of the Certificate of Release of Federal Tax Obligation Lien. The existing form of the Notification of Federal Tax obligation Lien utilized by the internal revenue service consists of a provision that supplies that the NFTL is launched by its own terms at the verdict of the law of restrictions period defined above offered that the NFTL has actually not been refiled by the day suggested on the type.

The term "levy" in this narrow technological sense denotes a management action by the Internal Income Service (i.e., without litigating) to take residential or commercial property to satisfy a tax obligation liability. The levy "consists of the power of distraint and seizure by any means. The basic guideline is that no court permission is needed for the IRS to execute a section 6331 levy.

The notification of levy is an internal revenue service notice that the internal revenue service plans to take building in the close to future. The levy is the actual act of seizure of the residential property. As a whole, a Notice of Intent to Levy have to be issued by the IRS at least thirty days before the real levy.

While the government tax obligation lien uses to all residential or commercial property and civil liberties to building of the taxpayer, the power to levy is subject to particular constraints. That is, specific home covered by the lien might be excluded from a management levy (building covered by the lien that is excluded from management levy may, nevertheless, be taken by the internal revenue service if the IRS obtains a court judgment).

Tax Lien Investing Scams

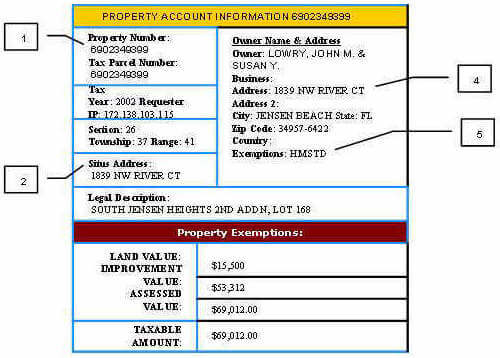

In the United States, a tax obligation lien might be placed on a house or any various other genuine residential property on which residential property tax is due (such as an empty system of land, a boat dock, or also a car parking location). Each area has differing policies and policies regarding what tax is due, and when it is due.

Tax lien certifications are provided promptly upon the failure of the building owner to pay. The liens are normally in very first placement over every various other encumbrance on the residential property, including liens secured by finances against the residential or commercial property. Tax obligation lien states are Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Mississippi, Missouri, Montana, Nebraska, Nevada, New Jersey, New York, Ohio, Rhode Island, South Carolina, Vermont, West Virginia, and Wyoming.

Tax acts are released after the owner of the home has fallen short to pay the tax obligations. Tax obligation liens and tax obligation actions can be bought by an individual financier. If the building is not redeemed, the deed owner or lien owner has initial placement to have the residential property after any type of other taxes or costs are due.

See 26 C.F.R. area 601.103(a). 326 UNITED STATE 265 (1945 ). UNITED STATE Constit., art.

Latest Posts

Tax Forfeited Property

Back Tax Property For Sale Near Me

Government Taxes Foreclosures