All Categories

Featured

Table of Contents

The initial proposal for the Treasurer's Deed public auction will certainly be established by the Treasurer and legal owner at the redemption quantity for the lien plus actual fees and expenses connected with the public auction by the Treasurer's Office. If there are no quotes at the Treasurer's Deed public auction, the Treasurer's Deed will certainly be issued to the authorized holder who requested the general public auction.

Since November 1, 2019, the SCDOR documents mention tax obligation liens online in our thorough State Tax obligation Lien Registry at . tax lien certificate investing risks. The computer registry consists of all unsettled state tax obligation liens that were previously submitted with region offices. State tax liens are currently provided and pleased with the SCDOR, not region offices

The existing lien balance on the State Tax obligation Lien Computer system registry consists of repayments made toward the debt and extra penalty and rate of interest accrued. If a taxpayer owes the SCDOR and forgets or fails to pay a tax financial debt, the SCDOR can issue a state tax lien. A state tax lien is a case against your real and/or personal effects situated in South Carolina.

State tax obligation liens are energetic for ten years. You can not offer or refinance your building up until you pay off your tax obligation lien and get a clear title. Tax obligation liens may reduce your debt rating and effect your ability to get lendings or financing. Yes. Tax obligation liens are a public notice of debt.

Utilizing the State Tax Lien Computer registry at dor.sc.gov/ LienRegistry, locate the lien you require paperwork for using the search. When you've discovered the appropriate lien, click the number in the to check out the or click the date in the to watch the notice. Depending on your device settings, the notification will certainly download as a PDF or open in a new tab, so you can conserve or print it.

How To Invest In Tax Liens

The listing of buildings going to public auction at the tax lien sale is released in the county newspaper of record 4 weeks prior to the sale for 3 consecutive weeks. As a tax obligation lien financier, you have no right, title or rate of interest in the residential property. Registration opens at 7:30 AM on the day of the saleThe exact punctuation of the name you sign up with will end up being the name made use of on the tax obligation lien certificateTo register you will need to provide your: Call Address for checks & document Social Protection or Tax ID number Finished, authorized IRS W-9 form The sale will begin as quickly after 8:30 AM as all bidders are signed up.

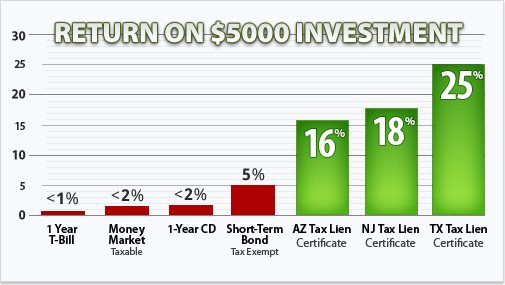

In recent years, the sale has actually not gone previous 3:00 PM. The rate is identified by the State of Colorado, and is set 9 percentage factors above the discount price at the Kansas City federal book financial institution, rounded up to the local whole percent. The listing is released in alphabetical order by proprietor name.

Tax Lien Investing Kit

Some homeowner might pay their tax obligations between our ad and the tax obligation lien sale, nevertheless, and will certainly not be consisted of. The auction is open bidding we do not turn via prospective buyers in a fixed order. The proposal amount is the premium quantity. No. You do not gain any kind of passion on a costs bid.

Historically, in Stone Region, the vast majority of tax obligation liens have actually marketed for a premium bid. As an example, if you place a premium quote of 6%and the redemption interest price is 10%, you will certainly lose money if the lien is retrieved prior to eight months pass. Tax obligation liens are a first, prior and perpetual lien versus the residential property.

The only lien in advance of a tax lien bought this year is a prior year's tax obligation lien. A buyer equilibrium sheet is offered whenever in the boardroom. A tax lien certificate is a lawful file that names you as the owner of the lien and establishes the rates of interest. Copies will be sent by mail to you within a week following the sale.

What Is Tax Lien Investing

Yes, tax lien certificates might be transferred to another celebration. All certificates need to be notarized Each certificate needs to be videotaped with the Stone County Clerk and Recorder There is a cost for tape-recording each certification The new certification holder need to finish an IRS W-9 kind If you hold a tax obligation lien, and the homeowner does not pay taxes in the next or list below years, you have the alternative of adding those delinquent tax obligations to your certificate. The Treasurer's Workplace monitors bankruptcies and collects taxes through the court.

Latest Posts

Tax Forfeited Property

Back Tax Property For Sale Near Me

Government Taxes Foreclosures